Strategy’s 713,502 BTC Stash Shocks Markets Despite $12.4B Loss

Key Takeaways:Bitcoin Treasury Expands as Holdings Cross 713K BTCDigital Credit Platform Gains MomentumFinancial Results Show Heavy Unrealized LossesCapital Markets Activity Drives Strategy’s ExpansionMarket Focus Turns to Bitcoin-Backed Credit Structure

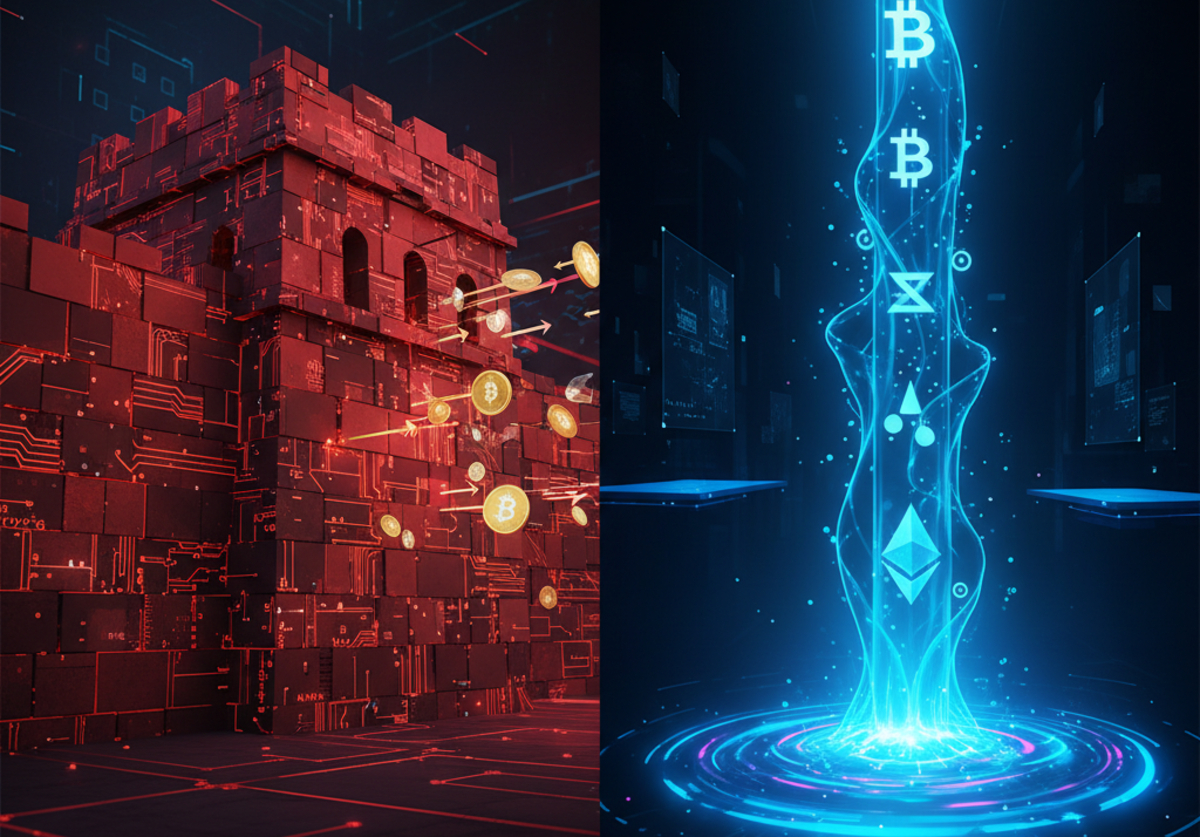

The executives claimed that they have combined Bitcoin wagers with credit instruments in order to stabilize things. MSTR stock provides you with a first-hand trial of BTC volatility, and STRC is regarding how to increase returns by means of structured financing.

They also revealed that new accounting changes and more transparent guidelines on digital assets were highly motivating factors forcing companies to get into Bitcoin in 2025. They are planning to continue expanding the credit component even in the process of gnashing BTC as long as the market is friendly.