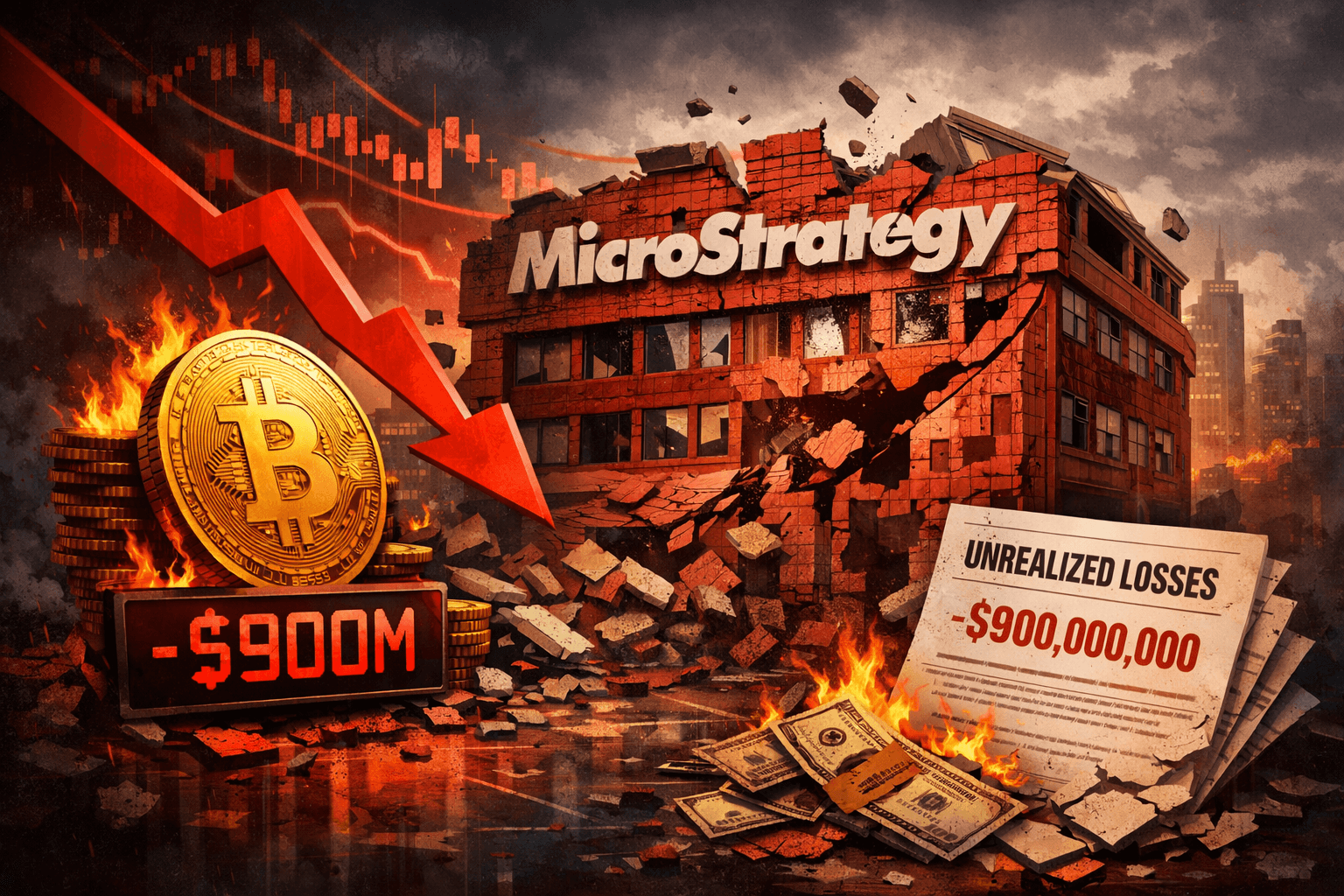

MSTR Price Dwindles as Strategy’s $BTC Holdings Show $900M in Unrealized Losses

MicroStrategy (MSTR) has long acted as a high-beta proxy for Bitcoin. But that leverage is a double-edged sword. As Bitcoin faces resistance, the valuation of corporate treasuries is suddenly under the microscope.

The accumulation patterns are distinct. Smart money is moving. Etherscan data reveals three high-net-worth wallets accumulated over $1M in the most recent buys, with the largest single buy hitting $500K. This isn’t retail behavior. These ‘whale’ wallets appear to be securing allocation in the infrastructure layer before the wider market catches on.

Currently priced at $0.013675, the $HYPER token serves as the fuel for this new ecosystem, handling gas fees and governance within the L2. The tokenomics include a high-APY staking mechanism immediately available after TGE, designed to incentivize long-term security. For investors watching MicroStrategy’s volatility with concern, the rotation into a protocol that offers yield and utility represents a logical hedge. The market is voting with its wallet, and the vote is for a programmable Bitcoin.

Visit the official Bitcoin Hyper site.

The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets, including presales and stocks like MSTR, are highly volatile. Always perform your own due diligence before investing.