The Road to 2026: How Policy and Products Reshaped the Crypto Market

To accommodate this influx of institutional capital, the crypto industry itself had to mature. Exchanges have had to evolve their structures to meet strict compliance mandates. Richard Teng highlighted this evolution, noting that 22% of the Binance team now works in compliance. This resource allocation acknowledges that for institutional capital to enter the fray, robust regulatory frameworks and secure infrastructure are non-negotiable prerequisites.

Regulation: The catalyst for the next trillion

While infrastructure provides the rails, regulation provides the green light. The primary driver of the capital rotation witnessed in 2025 is the shift in the United States from a perceived hostile regulatory environment to a supportive one. The signing of the GENIUS Act, which provides a federal framework for stablecoins, and the successful launch of spot ETFs have de-risked the asset class for compliance-minded investment committees.

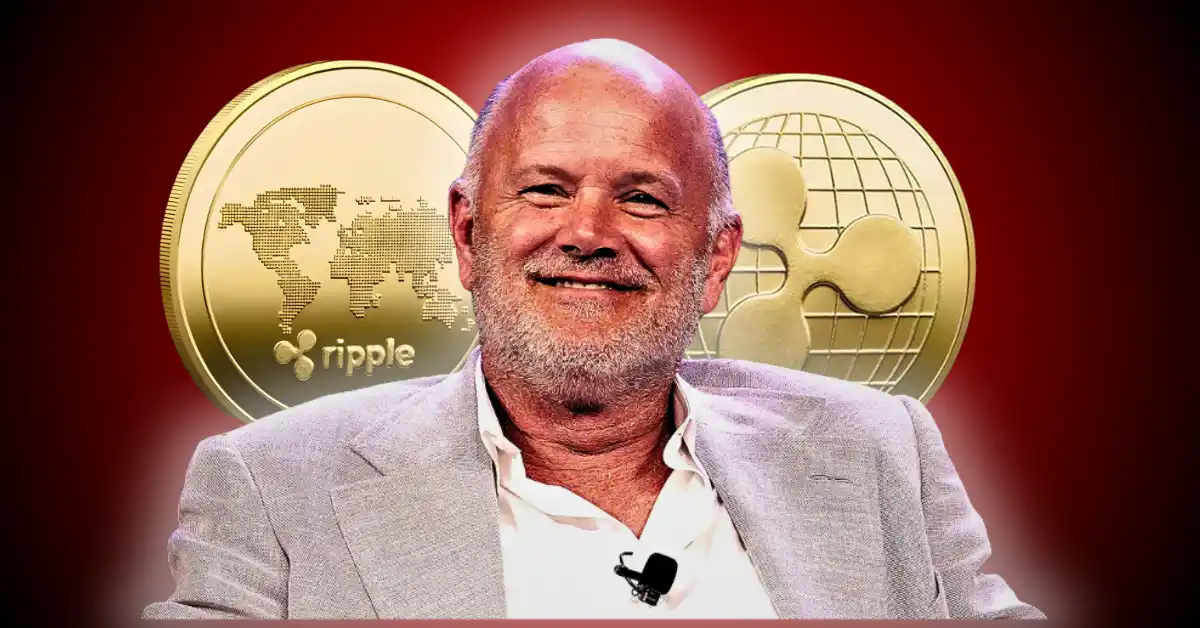

The numbers reflect this confidence. Investors poured $22.47 billion into Bitcoin spot ETFs and another$10.43 billion into Ethereum ETFs year-to-date. The demand for digital settlement rails is equally visible in the stablecoin market, where capitalization rose 49.17% to hit $312.63 billion. Policy changes drove much of this capital rotation. Speaking on a panel, Ripple CEO Brad Garlinghouse pointed to the market’s response to new rules, “Regulatory clarity in the world’s largest economy is a game-changer. People are under-pricing that.”

This clarity has altered investment theses. According to the Sygnum Future Finance 2025 report, 57% of institutional investors now cite portfolio diversification as their primary driver for entering the market—replacing speculation or high-risk returns.

This signals a critical maturity; institutions are buying digital assets to uncorrelated risk, not just to chase alpha. Despite this growth, crypto ETFs still represent only 1–2% of the global ETF market, implying that the sector has significant room for expansion as it heads into 2026.

The infrastructure for a connected economy

As the market looks toward 2026, the conversation is moving beyond simple asset allocation to the utility of the networks themselves. Stablecoins and blockchain rails are increasingly viewed as the internet of value, capable of settling transactions faster and cheaper than correspondent banking networks.

Adoption in Latin America, Asia, and the Middle East is accelerating faster than in Western markets, driven by the practical utility of digital payments. As technology merges with finance, it is building a network of unified liquidity. During her session at Binance Blockchain Week, Solana Foundation President Lily Liu highlighted the magnitude of this transition, “We’re building the financial infrastructure of the internet for 5.5 billion people,” she said.

This infrastructure is not just about trading tokens; it is about giving issuers access to global capital and users access to financial sovereignty. The institutional pivot is no longer a prediction—it is a documented financial trend backed by billions in inflows and legislative ink.

The era of the crypto winter has thawed into a spring of structural adoption. For Wall Street, the question is no longer if digital assets belong in a portfolio, but rather how significant that allocation must be to remain competitive in a digitized global economy.